Understanding Taxes: What the Rich and Businesses Really Pay

Taxes are a hot-button issue, and everyone has an opinion about whether the wealthy and corporations shoulder their fair share. Beyond the headlines, what do these groups actually contribute to the public coffers? Let's break it down.

Wealthy Individuals: More Than Just Income Tax

- Federal Income Tax: Yes, the highest earners pay the highest income tax rates. But it's progressive, meaning they pay a higher percentage as their income goes up.

- Capital Gains Tax: Selling stocks or investments? Those profits are taxed, but often at lower rates than regular income.

- Don't Forget the States: Many states have their own income taxes adding to the overall burden.

- Property Taxes: Owning a mansion or multiple properties translates to hefty property tax bills.

- Estate Tax: Only the extremely wealthy face this tax when assets are passed to heirs, and the threshold is quite high.

Businesses: A Complex Picture

- Corporate Income Tax: There's a federal flat-rate tax on business profits, though lots of deductions come into play.

- State and Local Taxes: Companies pay taxes where they operate, contributing to local services.

- Payroll Taxes: Employers cover part of their workers' Social Security and Medicare taxes – a significant expense.

- Property Taxes: Owning commercial real estate means more tax bills.

- Sales Taxes: In many areas, businesses collect sales tax on your purchases and send it to the government.

The Nuances

- Deductions and Credits: The tax code is full of these, and the wealthy and businesses often have expert help taking maximum advantage. This greatly reduces what they truly owe.

- Is it Fair? That's the big debate. Some argue they should pay more considering the vast income and wealth gaps. Others say they already bear the biggest tax burden.

Key Takeaway

The tax system is complex, and there are far more taxes in play than most people realize. Understanding all the pieces of the puzzle is the first step towards forming an informed opinion on whether the system is equitable, or if reforms are needed.

Taxes Paid by Wealthy Individuals

- Federal Income Tax: The US has a progressive income tax system, meaning higher income earners pay a higher percentage of their income in taxes. The highest federal income tax bracket is currently 37%.

- Capital Gains Tax: This tax applies to profits made from selling assets like stocks, bonds, or real estate. Capital gains have a lower tax rate than regular income, especially if the asset is held for over a year (then they're considered long-term capital gains).

- State and Local Income Taxes: Many states and municipalities impose their own income taxes in addition to the federal tax.

- Property Taxes: Individuals who own real estate pay property taxes based on the assessed value of their property.

- Estate Tax: This applies to very large estates passed down at death. Currently, only estates exceeding $12.92 million (for 2023) are subject to the estate tax.

Taxes Paid by Businesses

- Corporate Income Tax: Corporations pay a federal income tax, currently a flat rate of 21%.

- State and Local Corporate Taxes: Businesses often pay income taxes to the states and localities in which they operate.

- Payroll Taxes: Businesses pay half of their employees' Social Security and Medicare taxes.

- Property Taxes: Commercial property owners pay property taxes.

- Sales Taxes: Businesses may collect sales taxes on the goods and services they sell, which they then remit to the government.

Important Considerations

- Tax Deductions and Credits: Both individuals and businesses can utilize a range of deductions and credits to reduce their tax burden. This is a significant factor in how much they actually end up paying.

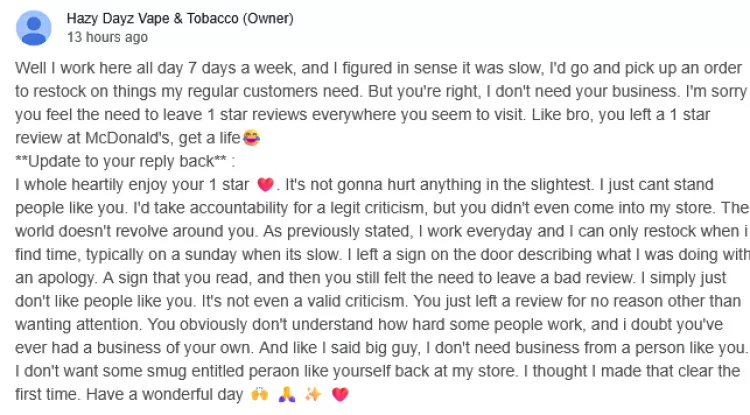

- Tax Avoidance vs. Evasion: There's a difference between legal tax avoidance (using the tax code to one's advantage) and illegal tax evasion (hiding income or assets). Wealthy individuals and corporations sometimes receive scrutiny for aggressive tax avoidance strategies.

- Debate and Controversy: The ongoing debate about whether the wealthy and corporations pay their "fair share" in taxes is complex. Proponents of higher taxes point to the concentration of wealth and income inequality, while others emphasize that high earners already contribute significantly to tax revenue.

What's Your Reaction?